The latest global crisis has spurred digitization across Africa. Businesses had to expand their online presence to survive. Consumers have been exploring telework. These conditions have also accelerated the growth of online trading. As mobile internet connectivity is improving, more and more residents are beginning to trade from their phones. Advanced financial apps are in demand.

Gone are the days when trading involved floor brokers. The global foreign exchange has no physical centre. It is a virtual over-the-counter market where buyers and sellers connect directly. In South Africa, access is provided by well-established international brokers. These companies provide clients with accounts, the necessary software, education and support free of charge. So, what can a smartphone app do?

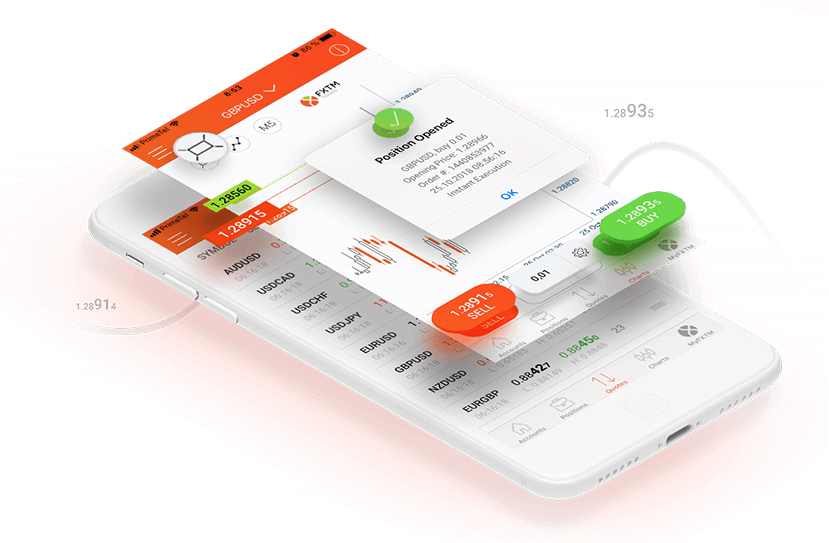

Trading via Smartphone

Users receive live currency rates around the clock. They can monitor their instruments easily, and manage trades through a special dashboard. This displays their balance, margin, results and more. They can also manage their accounts with the broker, make deposits and initiate withdrawals. This covers all the typical needs, from preliminary market analysis to a collection of profit.

First, a mobile app allows you to trade on the go. MetaTrader 5 is a mobile version of the eponymous desktop platform. Users receive live quotes and financial news right to their phones. They may open, manage and close trades easily. The mobile app may complement the desktop terminal, or be used independently.

What Can I Trade?

The range depends on your broker and the type of account you use. Aside from universal solutions like MetaTrader 5, there are signature apps developed especially for brokers. For example, the FXTM mobile trading app allows clients to access 250+ instruments. Powerful and versatile, it upgrades their online trading experience.

International brokers give access to:

- Major, Minor, and Exotic currency pairs;

- Spot gold and silver;

- CFDs on commodities;

- CFDs on stocks;

- CFDs on market indices;

- CFDs on cryptocurrencies.

Contracts for Difference (CFDs) are popular derivatives linked to various underlying assets. Their key advantages are convenience and potential for high profit. Holders of CFDs do not own the underlying asset. Instead, they speculate on price and receive the difference between their entry and exit.

For example, if you know how the oil market works, you can trade CFDs on UK Brent or US Crude. Similarly, CFDs on stocks are connected to equity prices for 180+ large corporations. CFDs on cryptocurrencies can be linked to Bitcoin, Ethereum and Litecoin. Finally, there are market indices like the S&P 500. These reflect the performance of large clusters of corporations from the US, Europe, Asia, and Australia.

Technical and Fundamental Analysis

Traders predict trends, so they can buy low and sell high. Technical analysts focus on past price patterns. Fundamental analysts pay close attention to news events. The app provides data for both models of decision-making.

There are dozens of technical indicators and customizable price charts. These built-in tools reflect the movements of currencies, stocks, and other instruments. Indicators help users to identify the best entry points for their trades. For example, MT5 includes 24 graphic objects: lines, geometric shapes, channels, Gann, Fibonacci and Elliott aids, etc.

Fundamental analysts have instant access to financial news. They can make effective decisions based on economic and political events that may sway currency values. News about corporate results allows them to buy and sell stocks at the right time.

Customizable Price Charts

Different trading strategies are based on different timeframes. For instance, scalpers focus on the shortest momentary movements. Position traders, on the other hand, analyse trends over weeks or months.

Smartphone apps come with zoom and scrolling options. This means users can study dynamics in minute detail. Although they work on the go, there is no shortage of data for meticulous analysis.

Other Features

The MetaTrader 4 and MetaTrader 5 apps allow algorithmic trading. Users can add Expert Advisors or automated trading robots. These pieces of software can analyse the market and execute trades.

EAs can be programmed to make decisions when the trader is busy, or give prompts when a lucrative opportunity arises. These robots can be downloaded for free from the provider, bought, or even rented.

Getting Started with ForexTime

To use a mobile trading app, you need a registered account. In South Africa, the industry is fairly regulated, and brokers have to be licensed by the FCSA to work. International brands comply with all regulations, such as negative balance protection, protection of clients’ funds, etc. They also receive oversight from FCSA. Make sure the company is legit before sharing any contact information.

Always start with a demo account — it allows you to practise in the app for free! When you are ready to take risks, switch to live and make the first deposit. Start small, follow a strategy, and achieve financial freedom!

Leave a Reply